As the World…Rotates

One of 2013’s early investment buzz phrases was “The Great Rotation” – the idea that investors were poised for a major turn away from bonds and toward stocks. Commentators have debated whether it would really happen, was already under way, or had come and gone.

U.S. equity mutual funds and ETFs did pull in a net $40.3 billion in July, eclipsing the old record of $34.6 billion dating back to February, 2000. And bond funds have seen redemptions as a long-awaited kick-up in yields produced negative total return on second quarter statements for many bond fund holders.

Market watchers continue to parse every utterance from any Federal Reserve governor to discern the timing and extent of the tapering of its bond purchases. Persistent, albeit deliberate, economic growth may well prompt the Fed to push the Fed Funds rate up from zero to more normal levels.

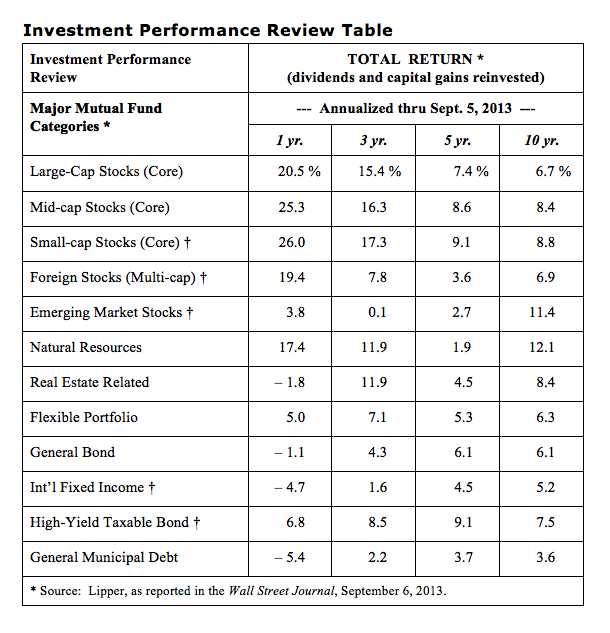

Of course a rotation of some consequence has already occurred. As shown below, the broad bond market outperformed stocks for the past 15 years (ending July 31st). But for the trailing ten years, stocks regained their edge and even led for the five years that commenced with the 2008-09 sell-off.

This is hardly an argument for dramatic changes in allocation to chase higher returns. Rather it’s a reminder that some meaningful results can be had by those who sustain a well-planned strategy through tough times, holding their own when others are rotating, revolving, pivoting, or whatever else the latest buzz might suggest.

Contact us if you would like a non-frenetic, balanced approach to developing a well-planned strategy that doesn’t react to every news report or pundits dire predictions.