Market Crests & After-Party: “What do you do with a drunken sailor…”

Most of us remember this old sea-chanty, but I think the ‘after-party’ implications of this song applies extremely well to today’s stock and bond market investors! Why? Considering the ‘party’ we have enjoyed over the past 6 years evidenced by today’s lofty stock and bond market levels, I think the danger of being complacent about the risks in the markets is a serious one! While we don’t agree with using the proscribed treatments for a drunken sailor from the song, such as tying him to the taffrail or shaving his belly or chin with a rusty razor, we believe wise investors should consider what actions might be sensible given today’s stock and bond market levels.

We have enjoyed a 6+ year recovery in the stock market off its lows in March of 2009 and a 32+ year bull for bonds since the early 1980s—which is the last time anyone really ever lost significant money in bonds.

One of the common descriptions of the Federal Reserve’s (Fed) job dates back to William McChesney Martin, Jr., who was Fed Chairman before Arthur Burns. In 1970, McChesney stated that the Fed’s primary job was “leaning against the wind”. He also famously said: “I’m the fellow who takes away the punch bowl just when the party is getting good,” which evidently was no problem for him since he was a ‘teetotaler’. So, the message is that at some point, the sun comes up, the party’s over and you have to face the rusty razor.

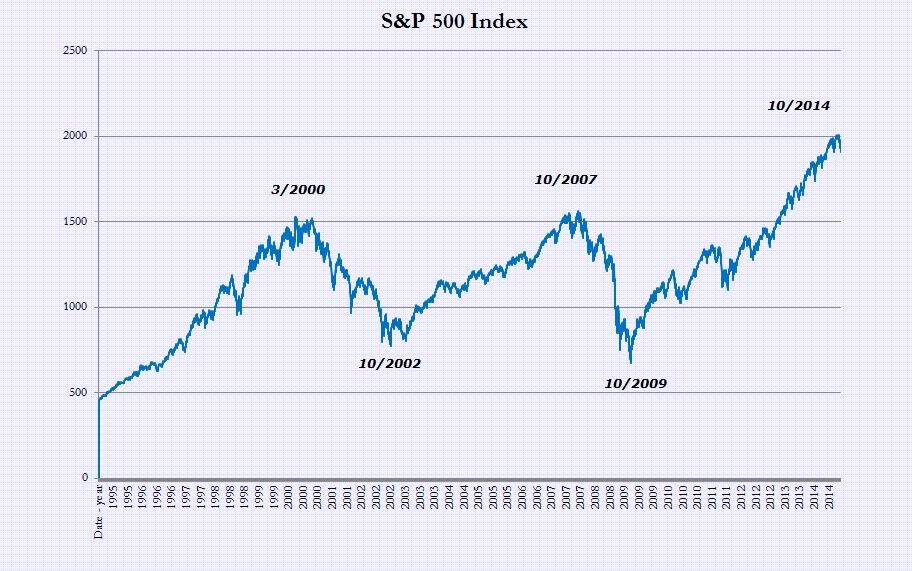

Here’s a chart that shows the market movement with approximately a 5-year bull, followed by a 2-year bear market over the past two major market corrections, beginning in 1995. Please keep in mind that past performance is not necessarily indicative of future returns.

So, as an advisor, what do you do with drunken sailors (investors)? Here’s what we are suggesting today for some of our clients.

First, all the major stock indices in the US and many overseas are now or have recently touched the highest levels in their history. Here are some charts illustrating this fact:

Dow Jones & NASDAQ

FTSE & Nikkei

Is it time to take away the punchbowl? Not necessarily—because the fundamentals of the economy are not grossly overvalued and neither are corporate earnings at present. However, we are definitely suggesting taking profits or capturing these high market valuations for some of our clients. How?

Capturing the Market Crests

Most of our clients have variable annuity accounts, much to the chagrin of some financial pundits who seem to hate these vehicles in a less-than-rational way. As a result of the good performance of the underlying stock and bond markets, these accounts have increased in value and have ‘captured’ or ‘locked-in’ these high market valuations for the assets already in those accounts. One way of further ‘capturing’ these high market valuations is to consider either adding new assets into those existing contracts which permit additional infusions of capital or opening a new contract if an existing contract does not permit additional premium payments.

Many of these older contracts have living benefit riders which are no longer available in as attractive an array or at the lower costs of those older contracts. In many cases, since our clients have owned these for several years, our clients are closer to the point where they will begin to withdraw income from these sources of lifetime guaranteed income. Without a doubt, with retirement just around the corner, they understand how critical increased lifetime income is to the viability of their long-term retirement picture.1 Like most other products in the financial world, variable annuities have continued to evolve over the past 10-15 years. New contracts have features and benefits that are very sensible to consider, such as daily, monthly or quarterly market step-ups. This increases the potential that a client will lock-in the gains the market may provide and enjoy the benefits of the resulting higher income payout for the rest of their lives.

Joint-Life Living Benefits

Another critical benefit of annuities in general relates to their unique ability to provide a joint-life payout for a single-life retirement account like an IRA. Most of today’s variable annuities, for example, provide a joint-life, living benefit rider for an additional fee. As you may know, your 401k, 403b, IRA, Roth IRA, accounts are all ‘individual retirement accounts.’ When the IRS mandates that an IRA owner begin to withdraw funds in the year after they turn 70 ½ , that calculation is based on the IRA owner’s individual lifespan and is designed to provide retirement income for the rest of that person’s life expectancy. That may be fine for that individual, but what about their spouse or life-partner?

If you elect to purchase an additional living benefit rider, the variable annuity will extend the same guaranteed lifetime income in an IRA or rollover IRA from other retirement plans (401k, 403b, etc) from a single individual to their spouse as well.

If you are the individual in the household with the larger IRA or Rollover IRA from a 401k account, this won’t affect your life at all. For your spouse, however, it is a VERY big deal because when an individual IRA account owner dies, the spouse only inherits the value of the remaining assets. What the variable annuity with a joint-life payout does, however, is to guarantee both spouses will receive lifetime income at the same level regardless of whether or not there is anything left in the account.

‘Tax-Deferred Wrappers’

Another major evolutionary characteristic of today’s variable annuities is what we like to call ‘tax-deferred wrappers’. These are stripped-down, low-cost variable annuities which have very little or no additional guarantees like living or death benefits. These are designed to allow contract owners to move non-qualified (or non-retirement account) assets into the tax-deferred shell of a variable annuity contract at a very low cost.

Why do this? While you will be taxed on the amount above your original purchase when you withdraw funds in the future, you will NOT be taxed on capital gains or investment interest each and every year. This means that unlike when you hold a mutual fund for 10-20 years, Uncle Sam is not taking his pound of flesh each and every year. That gives the investor the potential benefit of tax-deferred compounding to accumulate as much as they can before taking funds out of that environment.

Why is this a big deal? As many investors discovered to their dismay this past tax year (2014), fund flows out of stock funds created situations in which their mutual funds didn’t appreciate much or may have even lost value, but those same investors were hit with large capital gains hits as a result of the portfolio manager’s needing to free up cash to meet the redemption demands of the mutual fund’s investors. Thus, despite not having more money from those mutual funds in terms of valuation of the account, these investors were forced to pay taxes from that account or other sources because of the internal trading activity of those mutual funds.

Those kinds of capital gains scenarios can be effectively ignored if those funds were in the ‘tax-deferred wrappers’ we are describing here because those internal capital gains and interest income expenses are not immediately taxable inside the ‘tax-deferred wrapper’ of a low-cost variable annuity contract. It also provides an excellent alternative for our clients who have high marginal tax brackets or trust accounts to invest funds in taxable fixed-income assets such as corporate or high-yield bonds without worrying about paying the income taxes on the income immediately. That provides excellent flexibility for trust investors and high-earning tax payers.

Costs & Drawbacks

Of course, variable annuities may not be appropriate for everyone and there are costs and drawbacks associated with the product. Let me divide the discussion between conventional variable annuities and the ‘tax-deferred wrappers’ we just highlighted.

For conventional variable annuities, the first potential drawback is the higher costs you are paying for the insurance you are buying inside any variable annuity. Variable annuities do cost more in general than an investment account with mutual funds, stocks, bonds, ETFs, etc., because you are buying insurance to guarantee an income for one or two lives off the initial premium plus any increases in your income base. In addition, these contracts have liquidity constraints either in the form of CDSCs (contingent deferred sales charges) or restrictions on the amount you can withdraw if you want to maintain your living benefit rider. These are complex instruments and as such, it behooves you to ask your advisor all the questions you can think of to understand how these work.

For the tax-deferred wrappers or ‘stripped-down’ versions of variable annuities, they have different challenges and drawbacks. It is true that they are lower in cost than more conventional variable annuities because they do not include living benefit or death benefit guarantees. Another issue to consider is how important immediate liquidity is to you. If you are completely interested in having the lowest possible cost in a contract, you might have to accept some CDSCs to enjoy the lowest costs. Thus, you will be sacrificing immediate liquidity in exchange for the lowest cost.

In some cases, these lower cost versions of variable annuities will allow you to add a living benefit rider at a later date—but you will have to pay the higher costs of such a rider. And while you can add a living benefit rider later, there is no guarantee that the same rider available today will be available at that future moment you choose to add one. Finally, as with any decision to place money in a tax-deferred environment like a variable annuity, or an IRA, 401k or tax-deferred retirement account, we do not know what the highest marginal tax bracket will be or at what income level those higher brackets will be triggered.

Conclusion

Drunken sailors are to be expected when the party has gone on as long and as productively as it has in the stock and bond markets over the past few years. We believe that some of our clients should consider taking some steps to lock in these gains. For those at or nearing retirement focusing on the importance of capturing asset growth and converting it into lifetime income is may be one of the sensible steps to take right now.

We think it is sensible to consider how valuable tax-deferred growth may be over the next decade or two using these low-cost variable annuities. Keep in mind, however, that without a living benefit guarantee in force, the investments in these vehicles are subject to same loss or gain potential as any investment.

As the title of my blog indicates, sometimes it is smart to ignore some of the investment advice you see out ‘there’ on the Net. One common theme out there representing investment advice we believe you should ignore and that we regularly ignore is the advice that “Whatever you do, don’t buy variable annuities.” We respectfully disagree and our clients are, in our opinion, the better for it!

If you’d like to learn more about our thinking and exploring a mutually beneficial business relationship, please contact us at (206) 283-2345 or email us at [email protected]

- Note that lifetime income guarantees provided by the contract are based on the claims paying ability of the underlying insurance company.

Securities and Investment Advisory Services offered through KMS Financial Services, Inc.

To get an overview of economic conditions, use this link. It’s updated monthly. http://www.russell.com/Helping-Advisors/Markets/EconomicIndicatorsDashboard.aspx

Past performance is not indicative of future returns.

Investing in securities of any type involves certain risks, including potential loss of principal. Investment return and principal value in a bond and/or securities portfolio will fluctuate so that investments, when sold or redeemed, may be worth more, or less, than the original investment.

Investing in sectors may involve a greater degree of risk than investments with broader diversification. International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Investing in emerging markets can accentuate these risks.